The Ultimate Guide to How to Invest and Make Money Daily: Proven Strategies for Consistent Profits 2025

Investing can seem like a daunting task, especially when you aim to make money daily. However, with the right strategies and understanding of various investment vehicles, you can create a steady stream of daily income. This guide will provide you with practical tips and insights on how to invest and make money daily, ensuring that you can achieve your financial goals.

Understanding Daily Investment Opportunities

1. Stock Market Trading

Day Trading

Day trading requests buying and selling stocks on the same trading day. It requires a good understanding of the stock market, quick decision-making skills, and the ability to manage risks. Day traders often use technical analysis and chart patterns to make informed decisions. One of the keys to successful day trading is to stay informed about market trends and news, which can have a significant impact on stock prices.

Day trading is a high-risk, high-reward activity. Successful day traders often have a deep understanding of market psychology and technical analysis. They use tools such as moving averages, candlestick charts, and volume indicators to make quick trading decisions. It’s also crucial for day traders to have a disciplined approach to risk management, including setting stop-loss orders and limiting the amount of capital invested in any single trade.

Swing Trading

Swing trading is a strategy where traders hold stocks for a few days to weeks to capture short-term price movements. Unlike day trading, swing trading does not require constant monitoring of the markets, making it suitable for those with other commitments. Swing traders often use both technical and fundamental analysis to identify stocks with potential for short-term gains.

Swing trading offers a balance between the intensity of day trading and the long-term commitment of buy-and-hold investing. Swing traders aim to capture the “swings” in stock prices by buying at support levels and selling at resistance levels. They often look for stocks with strong momentum and clear trend patterns. Risk management is also important in swing trading, with traders setting target prices and stop-loss levels to protect their capital.

Resources for Stock Market Trading:

2. Forex Trading

Forex trading, or foreign exchange trading, involves buying and selling currencies. The forex market is the biggest and most liquid market in the world, running 24 hours a day. To make money daily in forex trading, you need to understand currency pairs, leverage, and risk management. Forex traders often use technical analysis, including chart patterns and indicators, to predict currency movements.

Forex trading offers several advantages, including high liquidity, the ability to trade 24 hours a day, and the use of leverage to increase potential returns. However, it also comes with significant risks, particularly for those who are new to the market. Successful forex traders develop a deep understanding of macroeconomic factors that influence currency values, such as interest rates, economic data releases, and geopolitical events.

Key Aspects of Forex Trading:

- Understanding Major and Minor Currency Pairs

- Leveraging Tools and Strategies for Effective Trading

- Risk Management Techniques in Forex

Resources for Forex Trading:

3. Cryptocurrency Trading

Cryptocurrency trading has gained popularity due to its high volatility and potential for significant returns. Platforms like Binance and Coinbase allow you to trade cryptocurrencies like Bitcoin, Ethereum, etc. It’s essential to stay updated with market news and trends to capitalize on price movements. Crypto trading involves buying and selling digital assets, often using a combination of technical and fundamental analysis.

Cryptocurrencies are known for their extreme price volatility, which can present both opportunities and risks for traders. Successful cryptocurrency traders stay informed about blockchain technology developments and closely monitor market sentiment. They often use technical indicators such as moving averages, Relative Strength Index (RSI), and Bollinger Bands to make trading decisions.

Popular Cryptocurrencies to Trade:

- Bitcoin (BTC)

- Ethereum (ETH)

- Ripple (XRP)

- Litecoin (LTC)

Resources for Cryptocurrency Trading:

4. Dividend Stocks

Investing in dividend stocks can provide a steady stream of daily income. Companies that pay dividends distribute a portion of their profits to shareholders regularly. By investing in a diversified portfolio of high-quality dividend stocks, you can earn a reliable income. It’s important to research and select companies with a strong track record of paying and increasing dividends over time.

Dividend investing is a popular strategy for those looking to generate passive income. Dividend stocks can provide a reliable source of income, especially when reinvested through Dividend Reinvestment Plans (DRIPs). Investors should look for companies with strong fundamentals, including stable earnings, low debt levels, and a history of consistent dividend payments.

Benefits of Dividend Stocks:

- Regular Income Through Dividends

- Potential for Capital Appreciation

- Dividend Reinvestment Plans (DRIPs)

Resources for Dividend Investing:

5. Real Estate Crowdfunding

Real estate crowdfunding platforms allow you to invest in real estate projects with relatively small amounts of money. These platforms pool funds from multiple investors to finance real estate projects, and investors receive a share of the rental income or profits from the sale of the property. Real estate crowdfunding can provide diversification and access to high-quality real estate investments that were previously only available to wealthy individuals.

Real estate crowdfunding offers a way to invest in real estate without the need for significant capital or direct property management. Investors can choose from a variety of projects, including residential, commercial, and mixed-use developments. It’s important to conduct thorough due diligence on the crowdfunding platform and the specific project before investing.

Types of Real Estate Crowdfunding:

- Equity Crowdfunding: Investing in real estate projects for a share of the profits.

- Debt Crowdfunding: Lending money to real estate developers for a fixed return.

Resources for Real Estate Crowdfunding:

6. Peer-to-Peer Lending

Peer-to-peer lending platforms connect borrowers with investors. By lending money to individuals or small businesses, you can earn interest on your investment. It’s crucial to diversify your loans to manage risk effectively. Peer-to-peer lending can offer higher returns compared to traditional savings accounts, but it also comes with higher risks.

Peer-to-peer lending allows investors to earn interest by funding loans to individuals or businesses. The platforms typically perform credit checks and assess the risk of each borrower, but it’s still important for investors to diversify their loan portfolio to mitigate risk. Interest rates on peer-to-peer loans can vary widely, depending on the creditworthiness of the borrower and the loan terms.

Advantages of Peer-to-Peer Lending:

- Higher Potential Returns

- Diversification of Investment Portfolio

- Support for Small Businesses and Individuals

Resources for Peer-to-Peer Lending:

7. High-Yield Savings Accounts

While not technically an investment, high-yield savings accounts offer higher interest rates compared to traditional savings accounts. They provide a safe and liquid way to earn daily interest on your savings. High-yield savings accounts are an excellent option for emergency funds or short-term savings goals, offering higher returns with minimal risk.

High-yield savings accounts are a low-risk way to earn interest on your savings. These accounts are typically offered by online banks, which can afford to pay higher interest rates due to lower overhead costs. While the returns are lower compared to other investment options, high-yield savings accounts provide safety and liquidity.

Features of High-Yield Savings Accounts:

- Higher Interest Rates Compared to Traditional Savings Accounts

- FDIC Insurance for Safety and Security

- Easy Access to Funds

Resources for High-Yield Savings Accounts:

Strategies for Consistent Daily Profits

1. Diversification

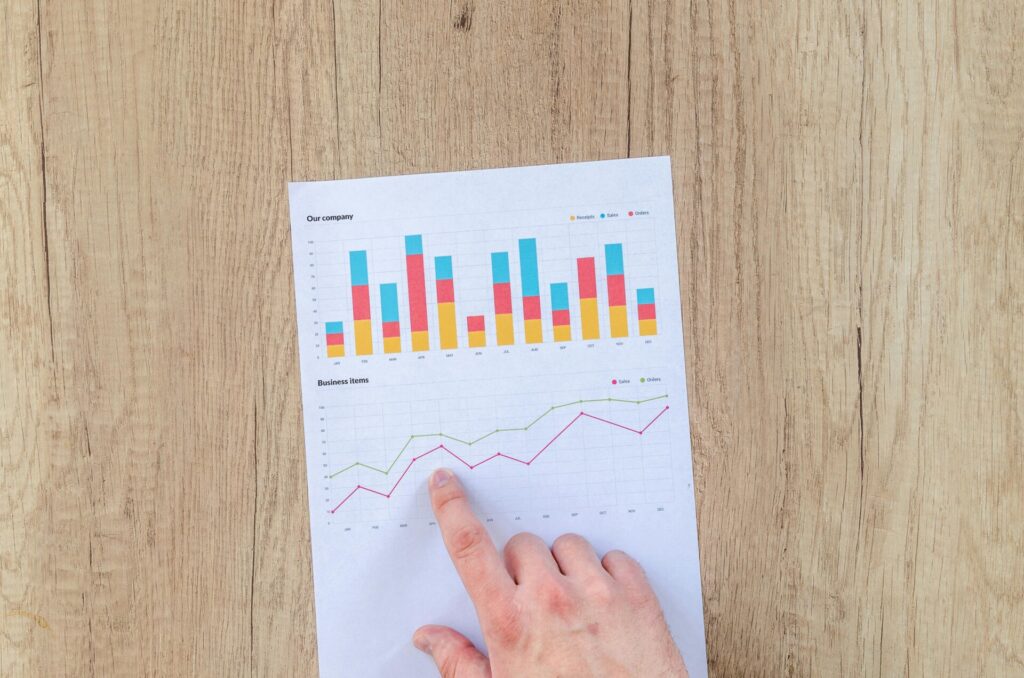

Diversification is a key strategy to minimize risk and ensure consistent daily profits. By diversifying your investments across various asset classes and sectors, you can mitigate the risk associated with the underperformance of any single investment. Diversification helps manage risk and improves the likelihood of achieving more stable returns over time.

Diversification entails distributing your investments among different asset classes, sectors, and geographical areas. By doing so, you can reduce the impact of any single investment’s poor performance on your overall portfolio. For example, a diversified portfolio might include stocks, bonds, real estate, and commodities.

Tips for Effective Diversification:

- Invest in a Mix of Stocks, Bonds, Real Estate, and Other Assets

- Consider Geographic and Sector Diversification

- Rebalance Your Portfolio Regularly

2. Risk Management

Effective risk management involves setting stop-loss orders, using leverage cautiously, and not investing more money than you can afford to lose. By managing your risk, you can protect your capital and ensure long-term success. Risk management strategies are essential for preserving your investment and achieving consistent returns.

Risk management is crucial for protecting your capital and achieving long-term investment success. This involves setting stop-loss orders to limit potential losses, using leverage cautiously, and diversifying your investments. Additionally, investors should regularly review and adjust their portfolios to ensure they align with their risk tolerance and investment goals.

Key Risk Management Techniques:

- Setting Stop-Loss Orders

- Using Leverage Cautiously

- Diversifying Investments

3. Staying Informed

Staying informed about market trends, economic indicators, and news is crucial for making informed investment decisions. Use reputable financial news sources, follow market analysts, and stay updated with economic reports. Being informed helps you anticipate market movements and make timely investment decisions.

Successful investors stay informed about market trends, economic indicators, and news that can impact their investments. This involves following financial news sources, monitoring economic data releases, and staying updated on developments in specific industries or companies. By staying informed, investors can make better decisions and adjust their strategies as needed.

Resources for Staying Informed:

4. Continuous Learning

Investing is a continuous learning process. Regularly read books, take courses, and attend seminars to improve your knowledge and skills. Continuous learning helps you stay ahead of the curve and adapt to changing market conditions. The investment landscape is constantly evolving, and staying updated with new strategies and insights is crucial for success.

Investing is a dynamic field that requires continuous learning and adaptation. Investors should regularly read books, take courses, and attend seminars to improve their knowledge and skills. By staying updated with new strategies and insights, investors can adapt to changing market conditions and enhance their investment performance.

Recommended Books for Investors:

- “The Intelligent Investor” by Benjamin Graham

- “Rich Dad Poor Dad” by Robert Kiyosaki

- “A Random Walk Down Wall Street” by Burton G. Malkiel

Conclusion

Investing and making money daily requires a combination of knowledge, strategy, and discipline. By exploring various investment opportunities like stock market trading, forex trading, cryptocurrency trading, dividend stocks, real estate crowdfunding, peer-to-peer lending, and high-yield savings accounts, you can create a diversified portfolio that generates consistent daily income. Remember to stay informed, manage your risks, and continuously learn to adapt to the ever-changing market conditions.

Investing with a focus on generating daily income can provide financial stability and growth. By implementing the strategies outlined in this guide, you can achieve your financial goals and build a sustainable source of daily profits. Always remember to invest wisely, stay disciplined, and continuously seek opportunities for improvement in your investment approach.

Additional Resources: